Getting My Paul B Insurance Medicare Part D Huntington To Work

Wiki Article

Paul B Insurance Medicare Insurance Program Huntington Can Be Fun For Everyone

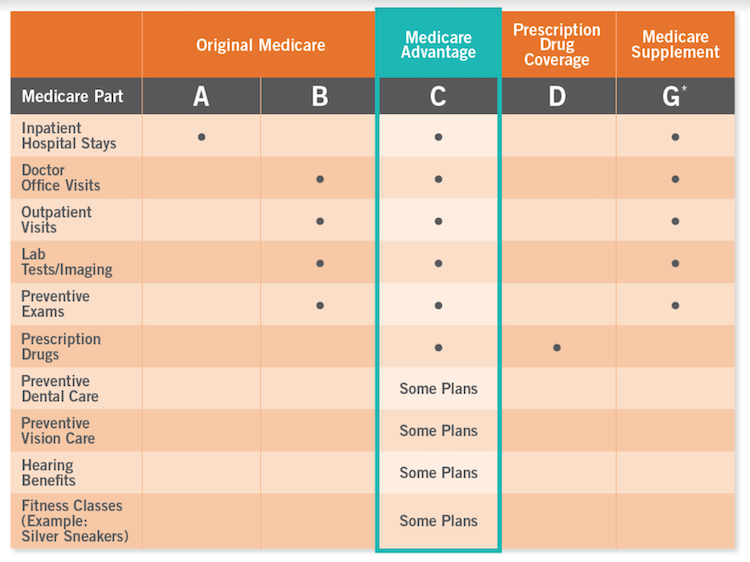

(People with certain handicaps or wellness problems may be qualified prior to they turn 65.) It's created to secure the wellness and wellness of those that use it. The 4 components of Medicare With Medicare, it is necessary to understand Components A, B, C, and D each part covers details services, from treatment to prescription medicines.

Initial Medicare covers only around 80% of healthcare facility as well as clinical expenses and also doesn't consist of prescription medication coverage. You require to have Part A, Component B, or both before you can obtain Component C. Part C called Medicare Advantage is another method to get Component An and also Part B protection.

If you're currently getting Social Security benefits, you'll immediately be enlisted partially An as quickly as you're qualified. Find out about when to enlist in Medicare. You can get Part A at no expense if you or your partner paid right into Medicare for at least ten years (or 40 quarters).

The Greatest Guide To Paul B Insurance Medicare Advantage Agent Huntington

Medicare Benefit is an all-in-one strategy that packages Initial Medicare (Component An and also Component B) with fringe benefits. Kaiser Permanente Medicare health plans are instances of Medicare Benefit strategies. Keep in mind that you need to be registered partially B and also eligible for Part A before you can register for a Medicare Benefit plan.

Searching for the ideal Medicare plan can be a little difficult, but it doesn't have actually to be complicated. It's all about being well-prepared and covering your bases.

Prior to we speak about what to ask, allow's speak about that to ask. There are a great deal of means to authorize up for Medicare or to get the info you require before selecting a strategy. For numerous, their Medicare trip begins straight with , the official internet site run by The Centers for Medicare and Medicaid Providers.

Not known Details About Paul B Insurance Insurance Agent For Medicare Huntington

It covers Part A (medical facility insurance) and also Component B (medical insurance). These strategies function as an alternate to Initial Medicare, combining the insurance coverage alternatives of Parts An and B, as well as added advantages such as dental, vision and also prescription medication insurance coverage (Component D).

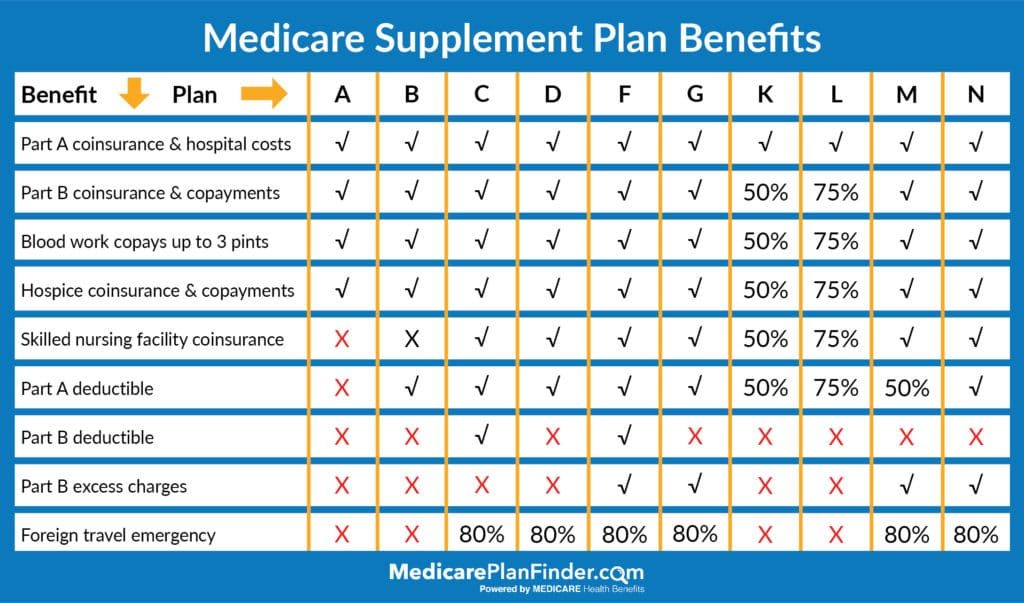

Medicare Supplement plans are a wonderful enhancement for those with Original Medicare, assisting you cover expenses like deductibles, coinsurance and copays. After receiving care, a Medicare Supplement strategy will certainly pay its share of what Original Medicare really did not cover then you'll be accountable for whatever stays. Medicare Supplement prepares commonly do not consist of prescription medicine coverage.

paul b insurance Medicare Supplement Agent huntingtonYou can register in a separate Part D strategy to add medicine coverage to Original Medicare, a Medicare Price strategy or a couple of other sorts of strategies. For many, this is often the very first question taken into consideration when looking for a Medicare strategy. The price of Medicare varies relying on your health and wellness treatment needs, monetary assistance qualification and just how you select to get your advantages.

Top Guidelines Of Paul B Insurance Medicare Advantage Plans Huntington

For others like seeing the doctor for a remaining sinus infection or filling up a prescription for protected antibiotics you'll pay a charge. The quantity you pay will certainly be different depending upon the kind of strategy you have and whether or not you've taken care of your deductible. Medicine is a vital part of care for many individuals, especially those over the age of 65.

and seeing a copyright that approves Medicare. What about taking a trip abroad? Several Medicare Benefit strategies supply worldwide protection, along with insurance coverage while you're taking a trip locally. If you intend on taking a trip, ensure to ask your Medicare expert concerning what is and isn't covered. Maybe you've been with your current medical professional for some time, and also you intend to keep seeing them.

Lots of people that make the button to Medicare proceed seeing their routine doctor, but also for some, it's not that basic. If you're working with a Medicare advisor, you can ask if your doctor will certainly be in network with your brand-new strategy. If you're looking at plans individually, you may have to click some web links as well as make some calls.

Things about Paul B Insurance Medicare Agency Huntington

gov internet site to look up your existing medical professional or another company, facility or medical facility you desire to use. For Medicare Advantage plans as well as Expense plans, you can call the insurer to make certain the physicians you desire to see are covered by the strategy you're interested in. You can also check the plan's site to see if they have an on the internet search tool to discover a covered doctor or center.

Which Medicare strategy should you go with? Beginning with a checklist of factors to consider, make certain you're asking the ideal inquiries as well as begin focusing on what type of strategy will best offer you and also your requirements.

Medicare Advantage strategies are personal insurance plan that assist with the gaps in Medicare insurance coverage. They sound comparable to Medigap plans, don't perplex the two, as they have some notable distinctions. To be eligible for Medicare Benefit enrollment, you must initially register for Original Medicare (Medicare Component An and Component B).

Report this wiki page